Stock Market & IPOs in India: Complete Guide for Smart Investors (2025 Edition)

The Indian stock market in 2025 is buzzing with opportunities, especially in IPOs. This guide explains stock market basics, the IPO process, Grey Market Premium (GMP), benefits and risks of investing, analysis of upcoming IPOs like Patel Retail, Gem Aromatics, and Mangal Electrical, along with expert strategies and FAQs for investors.

Introduction: Why IPOs Are Hot in 2025

The Indian stock market is buzzing with opportunities. With over 16 crore Demat accounts and thousands of first-time investors joining every month, India has become one of the most exciting investment destinations globally.

One area that grabs the most attention? Initial Public Offerings (IPOs).

From blockbuster listings like Ola Electric to promising SME IPOs such as Patel Retail, Gem Aromatics, and Mangal Electrical, investors are hunting for the next big opportunity.

In this guide, we’ll simplify everything:

-

What is the stock market and IPO?

-

How does IPO GMP today influence demand?

-

Which upcoming IPOs 2025 look promising?

-

Tips, risks, and real success stories.

If you’re serious about investing in IPOs or stocks, this blog is your go-to roadmap.

Stock Market Basics Every Investor Should Know

The stock market is a place where buyers and sellers trade shares of listed companies. It acts as a bridge between companies that need funds and investors who want to grow their money.

Key Stock Exchanges in India

-

NSE (National Stock Exchange) – Largest in terms of volume.

-

BSE (Bombay Stock Exchange) – Oldest in Asia.

Popular Market Indices

-

Nifty 50 → Tracks top 50 NSE-listed companies.

-

Sensex → Tracks top 30 BSE-listed companies.

Investors follow these indices to measure India’s economic health. When Sensex/Nifty goes up, investor confidence rises.

What is an IPO (Initial Public Offering)?

An IPO is when a private company offers its shares to the public for the first time. After listing, these shares can be traded on NSE/BSE.

Why Companies Launch IPOs?

-

To raise funds for expansion.

-

To reduce or clear debts.

-

To boost brand visibility.

-

To give early investors/promoters an exit route.

Why Investors Love IPOs?

Early entry into growing businesses.

Chance of listing gains (profit on day one).

Opportunity for long-term wealth creation.

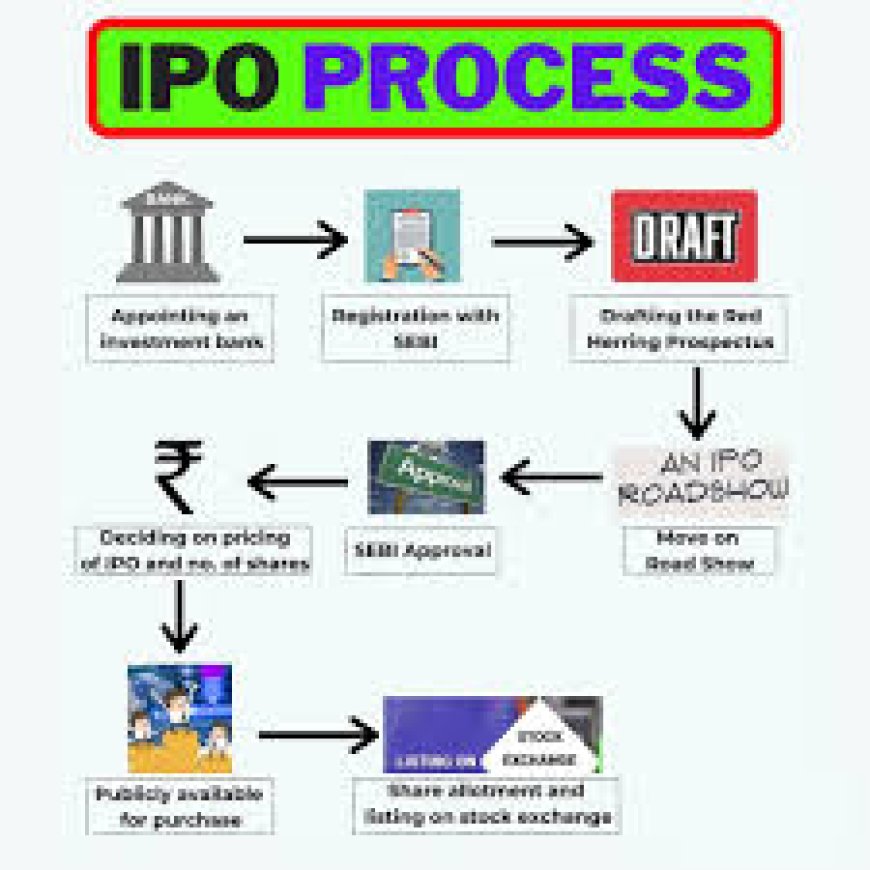

How to Apply for an IPO (Step-by-Step)

-

Track IPO Announcement → Read the company’s RHP (Red Herring Prospectus).

-

Apply Online → Through Net Banking (ASBA) or UPI apps like Google Pay/PhonePe.

-

Wait for Allotment → If demand is high, you may or may not get shares.

-

Listing Day → Shares list on NSE/BSE. Price may rise (gain) or fall (loss).

Pro Tip: Use multiple Demat accounts (family members) to increase allotment chances.

What is IPO Grey Market Premium (GMP)?

The Grey Market Premium (GMP) is the extra price traders are willing to pay for an IPO share before it gets officially listed.

-

Example: If issue price = ₹200 and GMP = ₹50 → Expected listing = ₹250.

-

High GMP = Strong demand.

-

But remember → GMP is unofficial, unregulated, and risky.

IPO Boom in India (2024–2025)

India is witnessing a historic IPO wave. In 2024 alone, IPOs worth ₹2.6 lakh crore hit the market. The momentum continues in 2025 with companies from retail, EV, infra, pharma, and fintech sectors going public.

Some Key IPOs to Watch in 2025

-

Patel Retail IPO → Strong consumer retail play.

-

Gem Aromatics IPO → Specialty chemicals with global demand.

-

Mangal Electrical IPO → Infrastructure + power growth story.

-

Ola Electric IPO (Listed) → Biggest EV IPO, still making headlines.

-

Other SME IPOs → Huge pipeline in mid-cap and small-cap space.

How to Analyse an IPO Before Investing

Before applying, check:

Company Fundamentals → Revenue, profit, debt.

Valuation → Is issue price fair compared to competitors?

Industry Outlook → Does the sector have growth potential?

Promoter Quality → Track record matters.

Use of Funds → Growth or just debt repayment?

Example: Ola Electric IPO got huge interest due to EV demand boom, while some overvalued IPOs in 2021 saw poor listings.

Benefits of Investing in IPO

-

Early Access to Growth Stories (like Infosys in the 90s).

-

Listing Gains – Quick profits possible.

-

Portfolio Diversification – New industries/sectors.

-

Long-Term Wealth Creation – Many IPOs turned into multi-baggers.

Risks of Investing in IPOs

-

Volatility Risk → Price may fall on listing.

-

Overvaluation Risk → Some IPOs are overpriced.

-

Market Sentiment Risk → Weak markets = poor listing.

-

Allotment Risk → Popular IPOs = low allotment chances.

IPO vs Stock Market Investment

| Feature | IPO (Primary Market) | Stock Market (Secondary) |

|---|---|---|

| Entry | At fixed issue price | At market-driven price |

| Demand | Limited subscription | Continuous trading |

| Risk | Listing risk | Market fluctuations |

| Reward | Potential listing gain | Long-term compounding |

Stock Market Trends in 2025

-

Retail Boom → More youth joining via apps like Zerodha & Groww.

-

Sector Rotation → EV, renewable energy, fintech, and FMCG in focus.

-

Global Confidence → FIIs continue investing in India.

-

Digital Access → IPO applications now just a click away.

Expert Tips for IPO Investors

Apply only in fundamentally strong IPOs.

Don’t rely only on GMP today.

Hold quality IPO stocks for long-term wealth.

Never invest borrowed money.

Read the RHP carefully – it’s the IPO’s report card.

Success Stories from Indian IPOs

-

Infosys (1993 IPO) → Now a global IT leader.

-

TCS (2004 IPO) → Created lakhs of crorepati investors.

-

Zomato (2021 IPO) → Huge listing gains, digital economy play.

-

Nykaa (2021 IPO) → Made strong debut, big brand value.

Lesson? Patience + right choice = wealth creation.

FAQs on IPOs in India

Q1. What is the minimum amount to invest in an IPO?

Usually, one retail lot (₹10,000–₹15,000 depending on IPO).

Q2. Can I sell IPO shares on listing day?

Yes, you can sell immediately or hold for long-term.

Q3. Is IPO GMP reliable?

It shows demand but is not SEBI regulated. Use only as an indicator.

Q4. How many IPOs can I apply for?

Unlimited, but allotment depends on demand and category.

Q5. Which IPOs are best in 2025?

Patel Retail, Gem Aromatics, Mangal Electrical are in spotlight.

Conclusion: Should You Invest in IPOs in 2025?

The IPO market in India is booming like never before. For retail investors, 2025 offers exciting chances in sectors like retail, EV, infra, and fintech.

But remember:

-

Do research.

-

Don’t chase hype.

-

Invest for the long-term.

IPOs are a gateway to wealth creation, but discipline is the real key.

If you choose wisely, the next Infosys or TCS could already be waiting in the 2025 IPO list.