New GST Rates on Cars 2025: Big Savings from ₹60,000 to ₹7.8 Lakh Explained

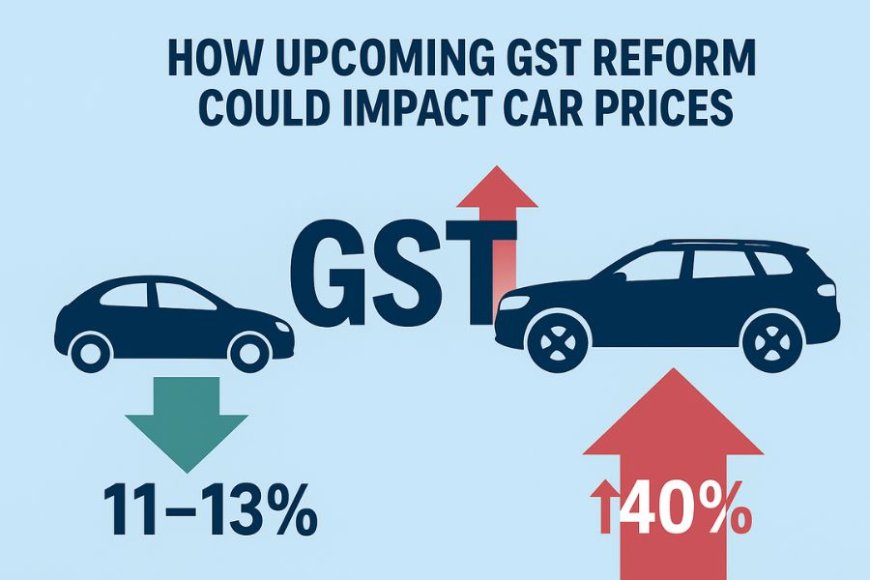

India’s new GST 2.0 has made cars significantly cheaper, with savings ranging from ₹60,000 on hatchbacks to ₹7.8 lakh on luxury SUVs. The revised GST rates simplify slabs to 18% for small cars, 40% for SUVs and luxury models, while EVs remain at 5%. Here’s the full breakdown of price cuts and benefits for buyers.

Introduction – Why Car Buyers Are Celebrating

Great news for car buyers in India! Starting September 22, 2025, the Government has rolled out a new tax system called GST 2.0, which has reduced GST rates on cars across different categories.

-

Small cars now attract 18% GST (earlier ~28–31% + cess).

-

SUVs and luxury cars are under a flat 40% GST, simplified from earlier complex structures.

-

Electric Vehicles (EVs) continue at just 5% GST.

This means cars just got cheaper — from entry-level hatchbacks like the Maruti Swift to premium SUVs like Toyota Fortuner and even luxury brands like Audi. Buyers can now save anywhere between ₹60,000 and ₹7.8 lakh, depending on the model.

So if you’re planning to buy a car this festive season, this might be the best time in years to book one. Let’s break it down in simple terms.

What Is GST 2.0 & Why Was It Needed?

Earlier Problem: Confusing Tax Slabs

Before this reform, cars in India were taxed under multiple slabs and cess rates. For example:

-

Small cars → 28% GST + 1–3% cess

-

SUVs → 28% GST + up to 22% cess

-

Luxury cars → 28% GST + 15–22% cess

This made pricing complicated and higher for buyers.

GST 2.0 Solution: Simple 3 Slabs

The GST Council simplified it into just three clear slabs:

-

5% GST → Electric Vehicles (unchanged)

-

18% GST → Small cars (under 4m length, engine ≤1200 cc petrol or ≤1500 cc diesel)

-

40% GST → SUVs, luxury, and bigger cars (no extra cess)

Impact → Lower taxes, transparent pricing, and car companies can pass benefits directly to customers.

How Much Can You Save? (Segment-wise Breakdown)

Here’s a quick comparison of old vs new GST rates and expected savings:

| Segment | Old Tax Rate (incl. cess) | New GST | Estimated Savings | Examples |

|---|---|---|---|---|

| Small Cars | ~29–31% | 18% | ₹55,000 – 1.06 lakh | Maruti Swift, Alto, Dzire |

| Compact SUVs | ~29–31% | 18% | ₹68,000 – 1.55 lakh | Tata Nexon, Mahindra XUV300 |

| Mid SUVs & MUVs | ~50% | 40% | ₹1.3 – 3.5 lakh | Mahindra Scorpio-N, Tata Safari, Toyota Innova |

| Luxury Cars | ~50% | 40% | ₹2.5 – 7.8 lakh | Audi Q8, BMW, Mercedes-Benz |

| EVs | 5% | 5% | No change | Tata Nexon EV, MG ZS EV |

Whether you’re buying a budget hatchback or a luxury SUV, the new GST slabs guarantee savings.

Brand-wise Price Cuts (With Examples)

Mahindra

-

Thar – ₹1.33 lakh cheaper

-

Scorpio-N – ₹1.45 lakh cheaper

-

XUV700 – ₹1.43 lakh cheaper

Tata Motors

-

Punch – ₹85,000 cut

-

Nexon – ₹1.55 lakh cheaper

-

Harrier – ₹1.40 lakh cheaper

-

Safari – ₹1.45 lakh cheaper

Hyundai

-

Tucson – savings up to ₹2.4 lakh

-

Other models: ₹60,000 – ₹1.23 lakh cheaper

Toyota

-

Fortuner – ₹3.49 lakh price cut

-

Legender & Camry – also cheaper by lakhs

Audi India (Luxury segment)

-

Audi A4 – ₹2.6 lakh discount

-

Audi Q8 – ₹7.8 lakh price drop

Nissan

-

Across models – up to ₹1 lakh savings

Auto companies have officially confirmed price cuts, so buyers can expect to see updated ex-showroom prices at dealerships from September 22.

Why This Is a Big Deal for Buyers

1. Festive Season Boost

The cuts come just before Navratri & Diwali, peak months for car buying. Expect heavy booking rush.

2. Better Finance Deals

Lower car prices → Lower loan amounts → More affordable EMIs.

3. Dealer Benefits

Dealers expect a sales surge of 15–20%, boosting India’s auto industry growth.

4. Wider Economic Impact

States like Gujarat, Maharashtra, and Tamil Nadu expect a spillover effect — better demand for cars means growth for local suppliers, MSMEs, and jobs.

Risks & Buyer Tips

-

Confirm prices after Sept 22 → Cars booked before may not get the revised GST benefit.

-

Model-wise variation → Discounts differ across trims, always check latest dealer price list.

-

State taxes still apply → Road tax, registration, insurance remain unchanged.

-

Book early → With high festive demand, waiting periods may increase.

-

Check financing options → Banks may revise car loan schemes to attract new buyers.

FAQs on New GST Car Rates

Q1. Do EVs get cheaper under GST 2.0?

No change — EVs remain at 5% GST, already the lowest.

Q2. Will road tax also reduce?

No. Road tax, registration charges, and insurance are separate from GST.

Q3. When do new GST car prices apply?

From September 22, 2025 onwards across India.

Q4. Are all brands passing on the benefit?

Yes, major automakers like Tata, Mahindra, Hyundai, Toyota, Nissan, and Audi have already announced official price cuts.

Q5. Should I wait or book now?

If your model has a long waiting period (like Scorpio-N or Nexon), it’s better to book early to lock availability at the new price.

Conclusion – Should You Buy a Car Now?

The GST 2.0 car tax reform is one of the biggest price cuts in the Indian auto market in recent years. With simpler tax slabs, transparent pricing, and savings up to ₹7.8 lakh, this is the perfect time for buyers.

Whether you’re eyeing an entry-level Maruti, a family SUV like Tata Safari, or a luxury ride like Audi Q8 — your dream car just got cheaper.

Pro Tip: If you plan to buy during the festive season, compare prices across dealers, book early to avoid waiting lists, and negotiate extra offers (insurance, accessories, exchange bonus).

India’s roads are about to see a record number of new cars — will yours be one of them?