Low-Cost Forex Trading in 2025: Top 10 Currency Pairs with Tight Spreads

Discover the top 10 low-spread forex pairs to trade in 2025. From EUR/USD to NZD/USD, learn which currency pairs offer tight spreads, high liquidity, and predictable moves. Perfect for scalping, swing trading, and trend strategies, these pairs help reduce costs and boost profit potential in the forex market.

If you’re trading forex in 2025, one thing is crystal clear — low spreads mean higher profits. The best currency pairs combine tight spreads, high liquidity, and predictable price movements. This keeps your trading costs low and your profit potential high.

In this guide, we’ll cover the Top 10 currency pairs with low spreads, why they’re so popular in 2025, and how to trade them effectively.

1. EUR/USD — The King of Forex

-

Why trade it?

The most traded currency pair in the world, making up a huge chunk of daily forex volume. -

Spread: As low as 0.1 pips on raw accounts.

-

Best for: Scalping, news trading.

-

Trading tip: Watch for U.S. Non-Farm Payrolls (NFP) and European Central Bank (ECB) news — big moves happen here.

2. USD/JPY — The Safe-Haven Favorite

-

Why trade it?

Strong stability, second most traded pair globally. -

Spread: Around 0.2–0.3 pips.

-

Best for: Trend traders, risk-off moves.

-

Trading tip: Best traded during the Asia–New York session overlap.

3. GBP/USD — Volatile but Profitable

-

Why trade it?

High volatility + low spreads = great breakout opportunities. -

Spread: Around 0.3–0.5 pips.

-

Best for: Swing trading, breakouts.

-

Trading tip: Focus on Bank of England and U.S. economic data releases.

4. AUD/USD — Commodity-Linked Mover

-

Why trade it?

Tracks commodity cycles and Chinese economic news. -

Spread: Around 0.5–0.6 pips.

-

Best for: Trend traders, commodity-based strategies.

-

Trading tip: Trade during Asian–London session overlap.

5. USD/CAD — Oil Price Influencer

-

Why trade it?

Moves closely with crude oil prices. -

Spread: Around 0.7–1 pip.

-

Best for: Macro and news trading.

-

Trading tip: Keep an eye on oil market reports and U.S. economic releases.

6. USD/CHF — The Risk-Off Hedge

-

Why trade it?

A safe-haven pair that moves opposite to risk assets. -

Spread: 0.5–1.2 pips.

-

Best for: Low-volatility trending.

-

Trading tip: Buy during global uncertainty, sell when risk appetite is strong.

7. EUR/JPY — The Cross-Currency Trend Rider

-

Why trade it?

A popular non-USD pair with good volatility. -

Spread: 1–1.5 pips.

-

Best for: Breakouts, cross-pair trading.

-

Trading tip: Great for traders who want volatility without U.S. dollar exposure.

8. EUR/GBP — Quiet but Profitable

-

Why trade it?

Moves on European political news. -

Spread: 1–2 pips.

-

Best for: Event-driven trades.

-

Trading tip: Perfect for traders who like slower-moving pairs.

9. GBP/JPY — The Volatility Monster

-

Why trade it?

High volatility + decent spreads = big profit potential. -

Spread: 1–2 pips.

-

Best for: Experienced traders only.

-

Trading tip: Tight stop-loss is key to avoid big losses.

10. NZD/USD — The Smooth Mover

-

Why trade it?

Clean trends and predictable moves. -

Spread: 0.6–0.8 pips.

-

Best for: Trend following.

-

Trading tip: Great for traders who like simple, structured setups.

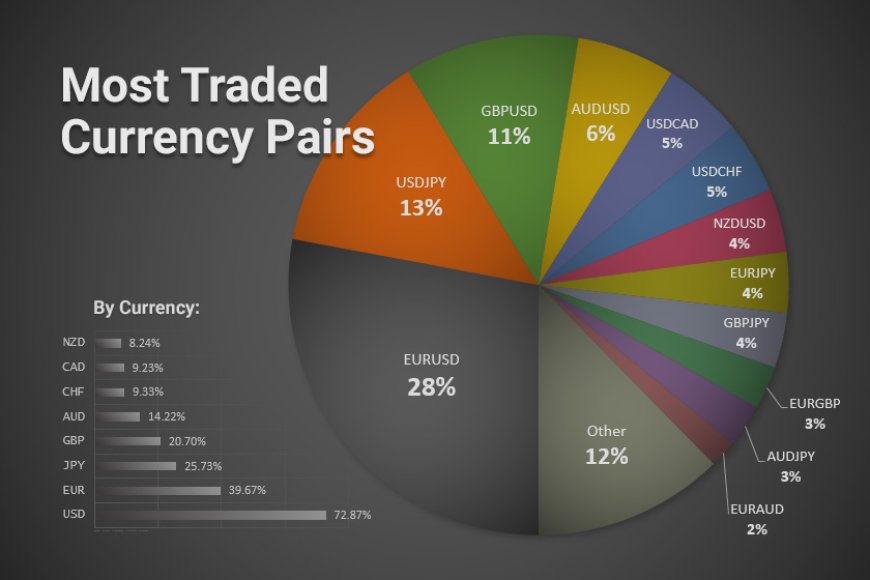

Why These 10 Pairs Are the Best in 2025

-

High Liquidity = Low Costs — More trading volume means smaller spreads.

-

G10 Currency Strength — All pairs involve stable, globally traded currencies.

-

Variety of Strategies — From safe-haven plays to high-volatility trades.

-

Macro-Driven Moves — Reacts well to news, giving predictable setups.

Best Trading Times

-

EUR/USD & GBP/USD: London–New York overlap.

-

USD/JPY & AUD/USD: Asia–London overlap.

Example Spread Table

| Pair | Spread (Raw) | Best For |

|---|---|---|

| EUR/USD | 0.1–0.2 pips | Scalping, news trading |

| USD/JPY | 0.2–0.3 pips | Safe-haven trends |

| GBP/USD | 0.3–0.5 pips | Breakouts, swing trades |

| AUD/USD | 0.5–0.6 pips | Commodity, trend trades |

| USD/CAD | 0.7–1 pips | Oil-linked moves |

| USD/CHF | 0.5–1.2 pips | Risk-off setups |

| EUR/JPY | 1–1.5 pips | Cross rate volatility |

| EUR/GBP | 1–2 pips | Political moves |

| GBP/JPY | 1–2 pips | High-volatility plays |

| NZD/USD | 0.6–0.8 pips | Smooth trend trades |

Final Thoughts

In 2025, these 10 low-spread forex pairs give you the perfect mix of liquidity, cost efficiency, and trading opportunity. Whether you prefer fast scalping on EUR/USD or trend-following with AUD/USD, there’s a pair to match your style.

Pro Tip: Always match your strategy with the pair’s personality. Tight spreads alone won’t guarantee profits — but they’ll make your winning trades even more rewarding.