India GDP Growth 2025: Key Drivers, Projections & What It Means for You

India’s economy continues to shine in 2025 with a projected GDP growth of 6.5%. Explore Q1 performance, sectoral growth, government spending, trade outlook, and key risks shaping India’s economic future for investors, businesses, and policymakers.

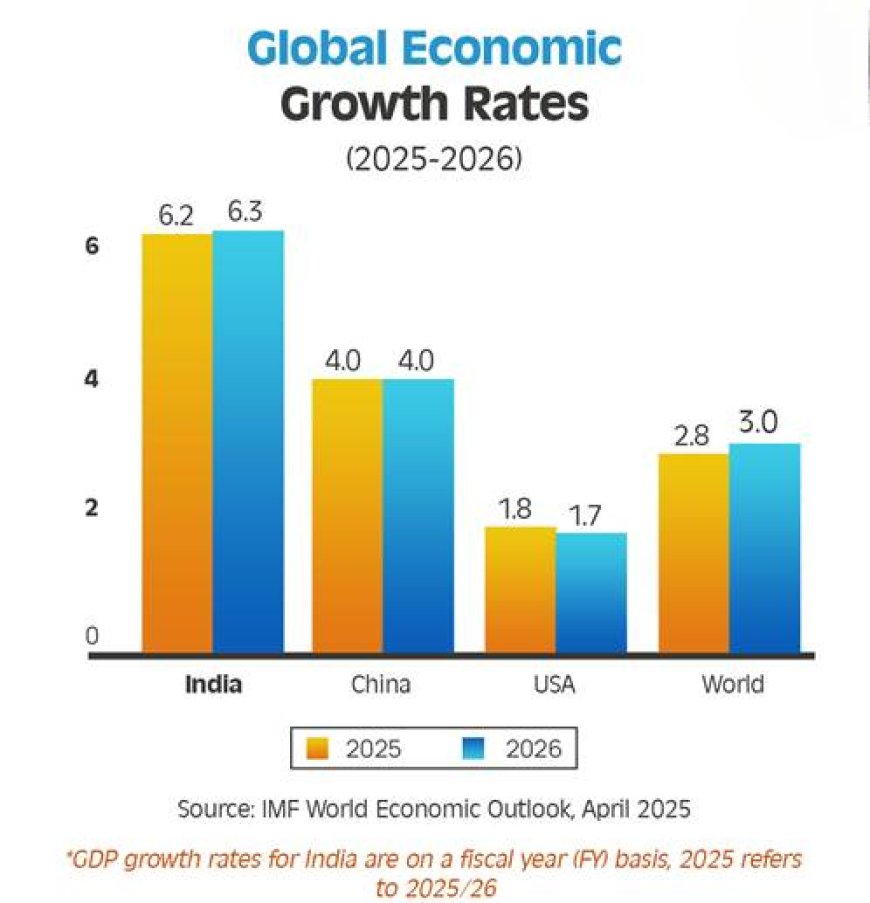

India continues to shine as a global economic bright spot in 2025. Amid global uncertainties, geopolitical tensions, and rising inflation worldwide, India remains one of the fastest-growing major economies, with a projected GDP growth of 6.5% for FY2025–26.

For investors, businesses, and policymakers, understanding the dynamics behind this growth is crucial. This blog breaks down quarterly performance, sectoral contributions, government policies, risks, global positioning, and future projections in a way that is simple, clear, and actionable.

Q1 FY26: A Surprising Strong Start

The April–June 2025 quarter delivered a 7.8% GDP growth, well above economists’ expectations of 6.7%—marking the highest quarterly growth since early 2024.

Main Growth Drivers:

-

Government Capital Expenditure:

The central government spent ₹2.8 lakh crore, a 52% YoY increase, driving investment in infrastructure, roads, ports, and urban development. -

Sectoral Contributions:

-

Manufacturing: +7.7%

-

Construction: +7.6%

-

Agriculture: +3.7%

-

-

Private Consumption:

Rising rural incomes and increased urban demand contributed to strong consumer spending.

Investor Takeaway: The combination of government spending and sectoral growth is creating a robust foundation for sustained growth.

Sectoral Analysis: Who’s Driving Growth?

India’s GDP growth is supported by diverse sectors, each showing unique strengths:

1. Agriculture

-

Grew by 3.7% in Q1 FY26

-

Strong monsoon season, government subsidies, and rural employment programs contributed to growth

-

Key crops: Rice, wheat, pulses, and sugarcane saw better yields

2. Manufacturing

-

Expanded 7.7% YoY, fueled by government incentives and the Make in India program

-

Electronics, automobiles, chemicals, and textiles led the growth

-

Export demand also picked up in H1 2025

3. Construction & Infrastructure

-

Construction grew 7.6%, driven by large government projects: roads, metros, and housing

-

Private sector housing demand surged with increased disposable income

4. Services Sector

-

Contributed ~55% to GDP

-

IT, telecom, retail, and logistics showed strong momentum

-

Growth fueled by domestic consumption and international outsourcing demand

Table: Sectoral Contribution to India GDP Q1 FY26

| Sector | Growth % | Notes |

|---|---|---|

| Agriculture | 3.7% | Strong monsoon, subsidies |

| Manufacturing | 7.7% | Electronics, auto, chemicals |

| Construction | 7.6% | Roads, metros, housing |

| Services | 6.2% | IT, telecom, retail |

| Total GDP Growth | 7.8% | Above expectations |

Full-Year 2025–26 Projections

Despite challenges like US tariffs, rising crude prices, and currency volatility, India is projected to maintain 6.5% GDP growth for FY2025–26.

Key Factors Supporting Growth:

-

Strong Domestic Demand

-

Rural and urban consumption remains high

-

Rising incomes and government welfare programs increase purchasing power

-

-

Government Reforms

-

GST rationalization, income tax cuts, and labor reforms are stimulating investment

-

Infrastructure investments are improving logistics and reducing costs

-

-

Stable Monetary Policy

-

RBI kept the repo rate at 5.50%

-

Ensures predictable borrowing costs for businesses and consumers

-

-

Exports Recovery

-

Despite US tariffs (up to 50%), export growth continues in IT services, pharmaceuticals, and agriculture

-

Challenges & Risks Ahead

While the outlook is positive, several risks could impact India’s economic performance:

-

Trade Tensions:

U.S. tariffs on textiles, chemicals, and certain manufactured goods could affect exports. -

Currency Volatility:

The Indian rupee has depreciated against the US dollar, raising import costs and inflation concerns. -

Inflation Pressure:

Food and energy price volatility could impact household consumption. -

Investment Bottlenecks:

Delays in regulatory approvals, land acquisition, and labor-intensive projects may slow private investment. -

Global Slowdown:

Economic slowdown in Europe or China may impact export demand and foreign investments.

India’s Global Economic Standing

India has now become the 4th largest economy globally, surpassing Japan, with a nominal GDP of $4.19 trillion.

Key Highlights:

-

Strong domestic market and young population

-

Continuous economic reforms

-

Rising foreign direct investment (FDI)

-

IT and services exports remain competitive globally

Why it matters: India’s growing clout on the global stage attracts international investors, strengthens currency reserves, and enhances trade partnerships.

Key Indicators of India’s Economic Health

| Indicator | Current Status (2025) | Impact |

|---|---|---|

| GDP Growth Rate | 6.5% projected FY26 | Strong economic momentum |

| Inflation (CPI) | 5.8% | Moderate, manageable |

| Unemployment Rate | 7% | Slight decrease, improving labor market |

| Current Account Deficit (CAD) | 1.2% of GDP | Sustainable, under control |

| Foreign Exchange Reserves | $630 billion | Provides buffer against external shocks |

| Fiscal Deficit | 5.6% of GDP | Slightly above target, manageable |

Why Investors Should Care

-

Robust Growth Sectors: Manufacturing, construction, and IT are thriving—good for equity investors.

-

Government Spending: Infrastructure projects create opportunities in materials, logistics, and real estate.

-

Stable Policy Environment: Predictable interest rates and tax reforms encourage long-term investment.

-

Global Positioning: India is attracting FDI and partnerships, boosting corporate earnings.

-

Demographics Advantage: Young, productive workforce ensures labor supply and consumption growth.

RBI & Monetary Policy Insights

The Reserve Bank of India has maintained a stable stance:

-

Repo Rate: 5.50%

-

Reverse Repo Rate: 4.00%

-

Inflation Target: 4 ± 2%

This ensures:

-

Affordable credit for businesses

-

Stable borrowing for households

-

Investor confidence in long-term economic stability

Infrastructure & Government Initiatives

Key Projects Driving Growth:

-

Bharatmala & Sagarmala: Road and port connectivity projects

-

Metro & Urban Development: Boosting construction and real estate

-

Smart Cities Mission: Urban modernization and job creation

-

Digital India: Expanding internet access and IT adoption

These initiatives create employment, enhance productivity, and attract private investment, driving GDP growth.

Agriculture & Rural Economy

-

Rural Employment Programs: MNREGA and skill development programs increase incomes

-

Agricultural Output: Higher crop yields and government subsidies

-

Rural Demand: Drives FMCG, consumer goods, and services

Impact: Rural spending fuels domestic consumption, supporting overall GDP growth.

Trade & Exports

-

IT & Services Exports: Continues to grow due to global digital demand

-

Manufacturing Exports: Facing headwinds from tariffs but compensated by diversification to Europe & Asia

-

Agricultural Exports: Rice, spices, and sugar exports remain strong

Key Insight: India’s export diversification strategy helps mitigate global trade risks.

Technology & Innovation

India’s GDP growth is also fueled by technology adoption:

-

IT services and digital platforms driving productivity

-

Fintech and digital payments increasing economic efficiency

-

Start-up ecosystem contributing to innovation and employment

Investor Angle: Tech sector remains a high-growth, high-return opportunity.

Conclusion

India’s GDP growth in 2025 highlights resilience, opportunity, and optimism. Key takeaways:

-

Q1 FY26 exceeded expectations with 7.8% growth

-

Strong government spending and sectoral growth are driving momentum

-

Stable RBI policy supports investor confidence

-

Risks exist, but fundamentals remain strong

-

India is now the 4th largest global economy, attracting investors worldwide

Bottom Line: India remains a must-watch economy for businesses, policymakers, and investors. Growth is robust, diversified, and backed by reforms—making 2025 a landmark year for India’s economic journey.